HubSpot Due Diligence Checklist for PE Firms

Read Time 4 mins | Written by: Eric Fouarge

Private equity firms increasingly rely on CRM data to validate revenue, assess go-to-market maturity, and uncover post-close value creation opportunities. Yet during technology due diligence, one of the most common blind spots is the actual health of the CRM, especially when that system is HubSpot.

On the surface, HubSpot dashboards may look polished. Pipelines appear full. Reports show growth. But without a structured HubSpot due diligence process, PE firms risk inheriting data issues, broken automation, and unreliable attribution that can materially impact valuation models and 100-day plans.

This HubSpot due diligence checklist is designed to help PE firms conduct a thorough CRM risk assessment, uncover hidden issues, and confidently evaluate whether HubSpot is an asset, or a liability, inside a portfolio company.

Why HubSpot Due Diligence Matters in Private Equity

During CRM due diligence for private equity, HubSpot is often treated as a reporting layer rather than a core system of record. That’s a mistake.

HubSpot touches nearly every revenue-critical workflow:

- Lead capture and routing

- Lifecycle stage progression

- Pipeline forecasting

- Marketing automation

- Revenue attribution

If any of these systems are misconfigured or poorly maintained, the downstream impact can include:

- Inflated pipeline values

- Inaccurate CAC and LTV metrics

- Misaligned sales and marketing teams

- Slower post-acquisition scaling

A proper HubSpot audit checklist ensures PE firms are evaluating not just what the data says, but whether the data can be trusted.

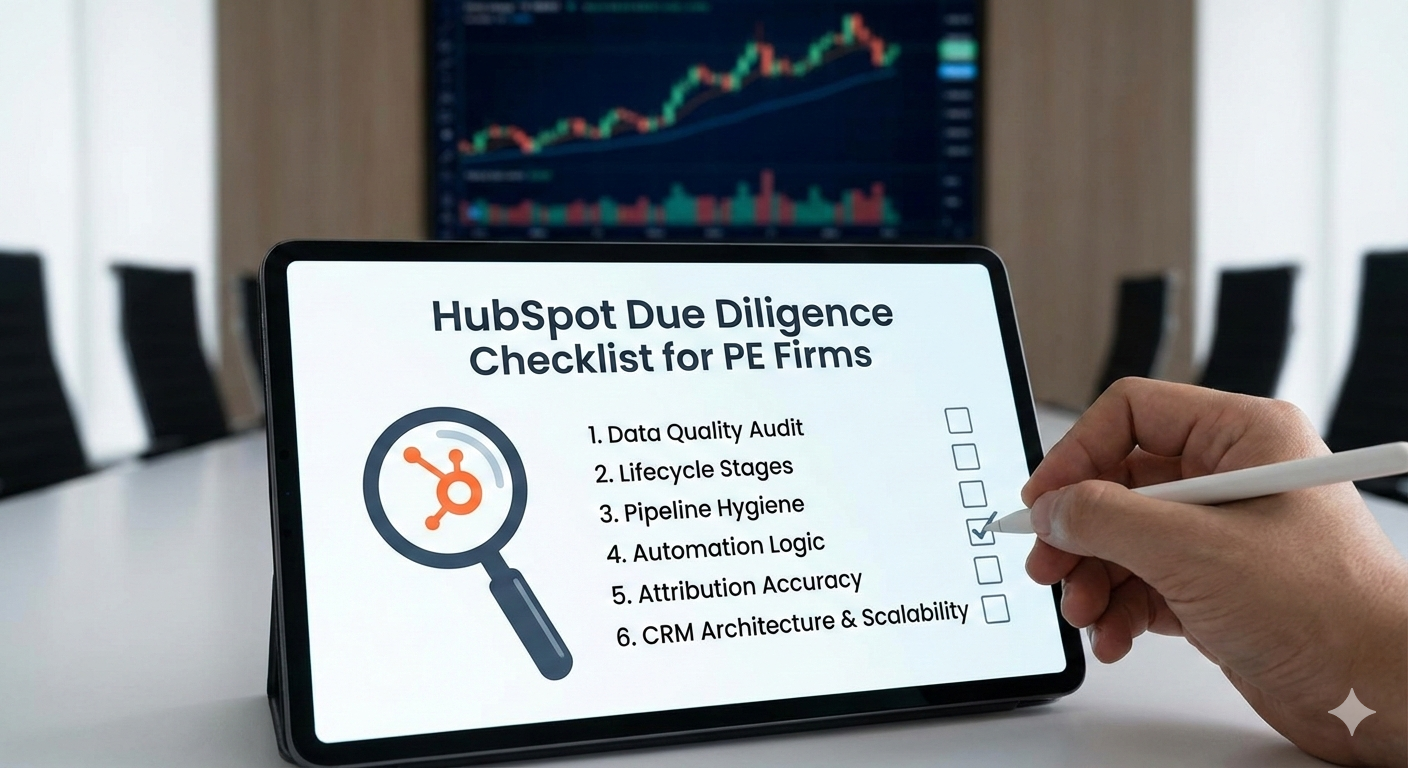

HubSpot Due Diligence Checklist for PE Firms

Below is a practical framework for HubSpot due diligence that can be applied during pre-close evaluation or early post-close assessment.

1. HubSpot Data Quality Audit

Data quality is the foundation of CRM evaluation in PE. Poor data hygiene undermines every report and forecast.

Key areas to review:

- Duplicate contacts, companies, and deals

- Inconsistent or missing required properties

- Free-text fields used where structured fields should exist

- Manual data entry overriding automation

Ask critical questions:

- Are lifecycle stages applied consistently?

- Are required fields enforced at the right stages?

- Is historical data usable for trend analysis?

A HubSpot data audit often reveals that reported growth is driven by inconsistent definitions rather than real performance.

2. Lifecycle Stages and Funnel Integrity

Lifecycle stages should reflect how revenue actually moves through the business—not how someone set it up years ago.

Checklist items:

- Clear definitions for each lifecycle stage

- Logical progression rules between stages

- No skipping or looping of stages

- Alignment between marketing, sales, and RevOps teams

Common red flag: Contacts marked as “Sales Qualified Lead” without any recorded sales activity.

This is a critical component of CRM risk assessment for PE firms because lifecycle confusion directly impacts conversion metrics used in valuation models.

3. Pipeline Hygiene and Deal Accuracy

Pipeline hygiene is one of the most overlooked areas of CRM due diligence in private equity.

Evaluate:

- Number of open deals with no recent activity

- Deals without close dates or amounts

- Multiple pipelines with inconsistent stages

- Stages that combine qualification and closing logic

Ask:

- Are win rates realistic based on historical data?

- Is pipeline coverage inflated due to stale deals?

A clean pipeline is essential for accurate forecasting and post-acquisition revenue planning.

4. Automation Logic and Workflow Risk

HubSpot automation can either scale revenue—or silently break it.

During a HubSpot audit checklist review, assess:

- Active workflows and their business purpose

- Conflicting automation rules

- Legacy workflows no longer aligned to the GTM motion

- Over-automation that creates data noise

Automation risk is a major factor in technology due diligence for CRM systems. Poorly documented workflows can create unpredictable outcomes after ownership transitions.

5. Attribution Accuracy and Revenue Reporting

Attribution accuracy is often assumed but rarely validated.

Review:

- Marketing attribution model configuration

- Consistency between HubSpot and financial systems

- Use of offline sources and manual deal creation

- Alignment between revenue reports and board-level metrics

If attribution cannot be trusted, CAC, channel performance, and growth efficiency metrics used during diligence may be fundamentally flawed.

6. CRM Architecture and Scalability

Finally, evaluate whether HubSpot is architected for scale.

Checklist considerations:

- Custom objects used appropriately

- Property naming conventions documented

- Permissions and user roles clearly defined

- Integration health with finance, data warehouse, and sales tools

This step helps PE firms assess whether HubSpot will support post-close growth—or require immediate remediation.

Turning HubSpot Due Diligence Into Value Creation

A thorough HubSpot due diligence process does more than identify risk. It creates a roadmap for:

- 100-day GTM improvements

- Forecast reliability

- Sales and marketing alignment

- Faster integration into portfolio reporting

For PE firms, HubSpot should be treated as a core operating system, not just a marketing tool.

Final Takeaway

CRM due diligence in private equity requires more than a quick dashboard review. A structured HubSpot due diligence checklist gives PE firms visibility into data quality, operational risk, and growth readiness before and after close.

When done correctly, HubSpot due diligence transforms CRM from a black box into a predictable, scalable revenue engine, unlocking real value across the portfolio.